A cryptocurrency is defined as a 100% digital asset that can be bought, sold, or traded. Its value is based entirely on supply and demand. There are thousands of different types of cryptocurrency, you’ve probably heard of some of the bigger names – Bitcoin, Dogecoin, Ethereum…

How does it work?

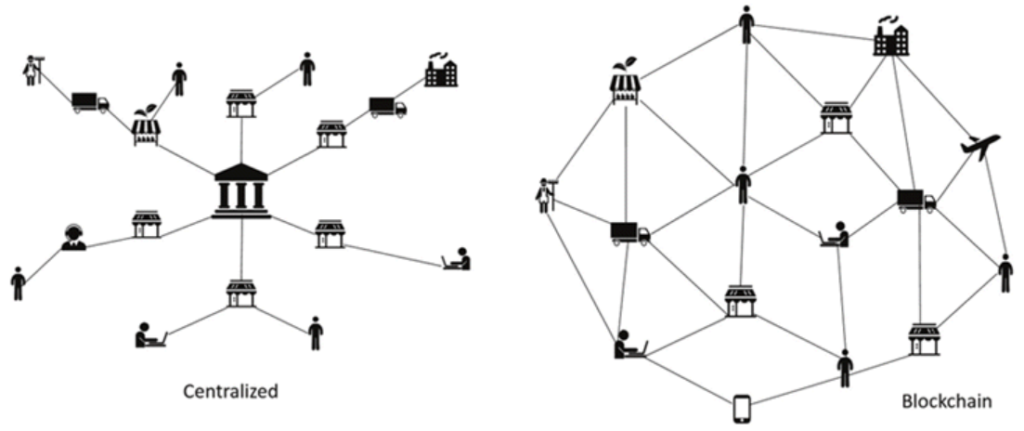

Cryptocurrency is not issued or managed by a centralized bank or similar institution. It’s a ‘peer-to-peer’ system, made possible with the use of a blockchain. OK, so, what is a blockchain? A blockchain is a secure system that tracks all transactions – like a huge shared, digital receipt that’s updated every time something new happens.

The big question: is cryptocurrency a commodity?

Traditionally, a commodity is a basic unit of raw material – sugar, iron, gold etc. Cryptocurrencies do behave in a similar way. Like commodities, they are interchangeable – each token or ‘coin’ is identical. They are also decentralized – traded between peers. Commodities are regulated by the Commodity Futures Trading Commission (CFTC).

Or is cryptocurrency a security?

Securities include stocks, bonds, mutual funds etc. They are defined by the way that the original owner will see a profit or loss, in return for an exchange between two people. Cryptocurrency is like a security because they can be issued like stocks. They also share a similar process to an IPO with Initial Coin Offerings – the capital-raising process for cryptocurrency. Securities are generally released by a centralized party, and regulated by the Securities and Exchange Commission (SEC).

The classification argument

In practice, classification depends on the type of cryptocurrency. The CFTC and SEC generally consider Bitcoin and Ether as commodities – because they can be freely traded on traditional asset markets, as well as cryptocurrency exchanges.

But Gary Gensler (the Chair of the SEC) has recently said the majority of cryptocurrency should be classed as a security, providing the public and investors with more protection against fraud and attacks.

This was disputed by Minnesota Republican Rep Tom Emmer who said most cryptocurrency or related offerings are commodities – so the SEC is not involved.

Why does all this matter?

The future of cryptocurrency depends on its classification. If cryptocurrency is defined as a security, it falls under the jurisdiction of the SEC, and is subject to rules on price transparency, greater reporting demands, and market abuse oversight. Arguably this offers investors more protection, however, it can limit the freedom of the market.

If cryptocurrency is defined as a commodity, the restrictions are generally a lot looser, giving investors more freedom, and allowing entrepreneurs to define the system through more innovation – but with more risk.

For example: The recent announcement of a new product called Lend by cryptocurrency platform Coinbase, intended to allow users to earn interest on certain coins. This project has recently been put on hold, due to a threat of subpoena by the SEC, stating that this project would contain securities.

In summary

The disagreement over classification reveals tension over how cryptocurrency is regulated and to what extent people – investors – should be protected in what is a very new, very volatile market.

Cryptocurrency is not yet mainstream. Increased regulation could help to legitimize the currency. Perhaps it needs its own classification?

Cryptocurrency is evolving fast; we all need to stay ahead of the curve. If you have questions on how we can help your business deal with financial and accounting matters related to cryptocurrency, get in touch with us here.