Talking with clients, our main concern today is the health and safety of our families and our work associates. It takes a huge support team to plant a crop. The current health threat reminds us how important the human element is to our team.

Focusing on business. I am working my way to a little more friendly soybeans. Short term it is all about meal usage. South American production will shrink in the WASDE this Thursday. Longer term we are seeing promising signs from Chinese demand.

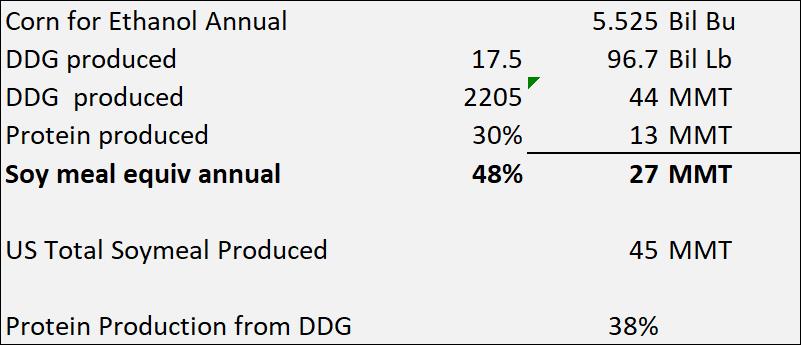

US DDG production from ethanol represents 38% of the US protein production. See numbers below. Ethanol production dropped 17% last week, and we expect it to drop much more in coming weeks. DDG prices are up $30/T and rations are moving back to soy meal. We will also lose a small piece of DDG production in the EU.

The US will have to slow soy and DDG exports, the importers – Philippines, Mexico, Columbia, Canada – still need the protein.

US domestic crush will be added to domestic rations. US soymeal and soybean exports will shrink as US soy crush stays as close to capacity as possible. . The only significant excess crush is in Brazil and China, China doesn’t count. The European meal importer will have to bid to get Brazil to crush beans rather than export to China. Who wins the bean auction between China and the EU? Soymeal at $300 looks cheap. Soybeans have little short term downside.

DDG Math: Each bushel of corn for ethanol produces 17.5 pounds of DDG. DDG are 30% protein, soymeal is around 48%.