China has apparently offered to purchase an additional $30 billion of US agricultural products as part of the new trade agreement. That sounds amazing! The additional purchases would apparently encompass ten commodities. I say apparently, because like much of the China trade news, it lacks any detail and substance and leaves us guessing the impact. The impact could be that China is “buying off” the US trade negotiators. “Buying off” is a term used this week by Secretary of Agriculture – Sonny Perdue. So, we ask the question: what does it look like? Would it mean China is buying US corn or wheat? Does it mean China is consuming more – that’s what’s important – will it be new demand?

We are not going to consider the bulk of what could be classified as Agricultural Trade and could be included in the additional $30 billion. This list includes among others: rubber and articles thereof, fish and crustaceans, beverages and spirits, fruits and nuts, preparations of cereal, and edible products of animal origin not specified elsewhere – I think that’s what goes in chicken nuggets. These will not be considered.

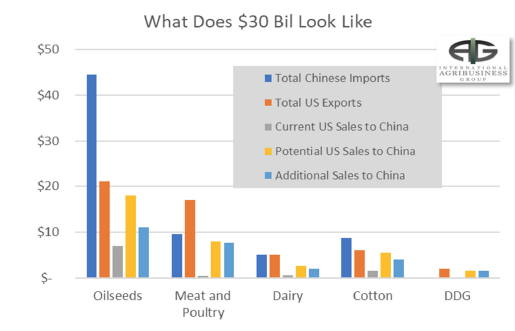

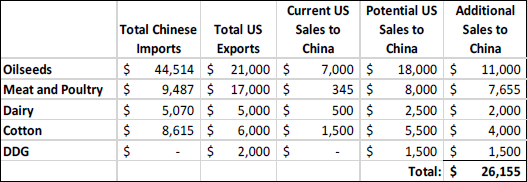

What will be considered for our purposes is a short list: oilseeds, meat and poultry, dairy, cotton, and DDG. With help from the table below, we derive almost $26 billion in potential additional US sales of agricultural products to China, without changing total Chinese imports or total US exports. We simply move origins and destinations. Increasing the sales of beef, pork, and poultry to China from 5% to 50% of US exports would probably not go unnoticed by Mexico, Japan, and South Korea – our largest animal protein customers. It would likely also be noticed by the EU, Brazil, and Canada – the largest suppliers of animal protein to China. Moving the meat trade would be disruptive to trade. Additional trade of oilseeds and cotton would create minor disruptions.

There are at least five ways to complete the deal without corn or wheat: 1. Include trade to Hong Kong. If Hong Kong is included, the total for our table goes well over $30 billion, 2. Sell sorghum, ethanol, DDG ($2 Bil. in 2015), soyoil, soymeal, 3. The items listed in paragraph two above represent $25 billion in Chinese imports, move 16% of those purchases to the US, 4. Round $26 billion to $30 – call it “close enough”, 5. The provision is never part of a trade deal – this may be most likely.

Does it mean greater Chinese demand? It must be part of a trade deal; therefore, a deal must be completed. A deal has to resolve the US steel tariff. If there is a deal, China committing to more trade does not mean a higher rate of demand growth, it only impacts origins, destinations, and shipping. If a trade deal is completed, we anticipate within 12 ‐ 18 months Chinese demand for Ag products would go back to the same growth trajectory as it was pre‐tariff, excluding impacts of ASF.

The major disruptor to Chinese trade – beyond the POTUS – is African Swine Fever (ASF). We anticipate pork import growth to accelerate when the Chinese consumer comes back to pork. ASF will create more volatility in meat trade for China until the Chinese production stabilizes. ASF is a subject of another paper.

$30 Billion sounds amazing, but we need a trade deal, and with a trade deal there are many ways to achieve the target without creating additional Chinese demand for ag products. There are many ways to achieve the target without additional US exports of corn. This doesn’t mean we are bearish corn.