How is it possible that crude oil is at negative values and ethanol prices are under $1 and the ethanol industry isn’t burning cash?

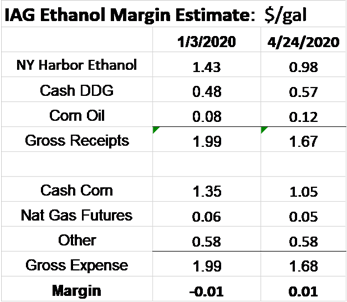

Look at the comparison of margins from last week to the first of January.

Ethanol production has declined by 45% the last 3 weeks. The sharpest decline in history for the fledgling industry. One would like to say that was due to insightful management in the ethanol industry, but that would be somewhat out of character. We have seen them burn cash with negative margins in the past, for longer than seemed necessary. The reason ethanol production halted so quickly was due to storage tanks being full. Full tanks and a quick shut down has saved the ethanol industry millions of dollars.

Ethanol production has declined by 45% the last 3 weeks. The sharpest decline in history for the fledgling industry. One would like to say that was due to insightful management in the ethanol industry, but that would be somewhat out of character. We have seen them burn cash with negative margins in the past, for longer than seemed necessary. The reason ethanol production halted so quickly was due to storage tanks being full. Full tanks and a quick shut down has saved the ethanol industry millions of dollars.

How did margins escape the war? Ethanol prices collapsed, but what happens when we lose ethanol production? We lose DDG and corn oil production and the price of DDG and corn oil move higher. Combine higher byproduct prices with sharply lower feedstock cost, and voila, margins magically stay the same.

Will margins stay at breakeven? We are in the process of moving animal diets away from DDG, back to more corn and soymeal. Therefore, DDG prices are unlikely to stay at current levels. Corn oil likely slides lower also, but lower corn prices keep margins close to breakeven.

The ethanol industry could come out of the Covid Recession without major damage. Plants that are producing ethanol today are producing cash. Plants that are shut down are burning small amounts of cash. That is a minor miracle given the apocalypse in the rest of energy sector.

What about politics? There was a positive vibe, albeit a weak beat, for ethanol at the beginning of 2020. Year around E15 was approved and the blender waivers had lost in court. I believe the EPA responds to the court decision with a significant reduction in the level of allowed waivers. I don’t believe EPA will reduce the RFS from the current rate of near 10%, even with the oil states screaming for help. Ethanol should have a growing share of the motor fuel market.

Ethanol stocks are now in corn. It’s bold for a reason. Ethanol stocks are now in corn!!

What matters to the ethanol industry today? What impacts the industry for the rest of 2020 and the beginning of 2021? Two factors: 1, when does America get back to work, and 2, where is the price of corn? Number 1 is tough, but I am guessing sooner than most believe. Number 2 is a little easier. Stocks to usage for corn will be the highest since 2004. Barring a weather issue, corn will stay cheap through 2020, but don’t expect cash corn to stay under $3 very far into 2021. Ethanol producers will likely have an opportunity to build maximum inventories of corn this fall with cheap basis. Unlike the fall of 2019 when stocks were limited and corn basis was expensive.

Bottom line: Well done ethanol industry, thanks to the lack of ethanol storage.