There is good news for US corn and soybean producers!!! More evidence arrives showing Chinese soy demand is coming back.

There seems to be an oversupply of bearish news for US crop producers. Ethanol production has been annihilated, meat demand is suffering, weather is good. All this adds up to a pile of corn that keeps a lid on most crop prices.

The one bright spot for crop producers would be the pace of Chinese imports of soy, even if it’s not from the US. As I have said for years, don’t waste time analyzing the US soy balance sheet. Save time and money; look at the world balance sheet. The Chinese demand has quickly recovered from ASF.

Soybeans are one of the purest world commodity markets. Pure as a result of several unique features: all soybeans are created equal, unlike wheat that has a multitude of types, grades, and qualities; soy production is concentrated in three major growing areas with balanced production from the US and Brazil; futures trade is concentrated on the CME.

Soy is a clean market excluding trade issues. Chinese tariffs on US soy would give Brazil a demand advantage with Chinese buyers. Executing the Phase 1 deal would give the US a Chinese advantage. Tariffs and trade deals aside, if soy is a “true” world market, then there is little difference if China buys US or South American beans. I only need to know if the Chinese buying is growing or contracting to determine the impact on price action. There is solid evidence Chinese buying is recovering from ASF at a faster pace than most expected.

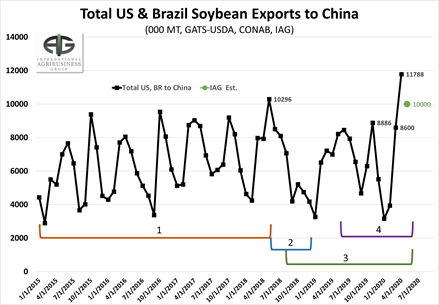

The chart to the right tells four stories: 1. Growing Chinese demand up to 2018, 2. Impact of tariffs in 2018, 3. The impact of ASF in China from 2018 into 2020, 4. The recovery of Chinese demand in 2020. Prior to April 2020, the largest single month export out of Brazil was just over 12 MMT. Total Brazil loadings last April were over 16 MMT with almost 12 MMT loaded for China. Preliminary data out of Brazil for May 2020 put our estimates for total loadings at 15 MMT. Brazil shipments to China in May are likely near 10 MMT. US shipments to China in each April and May are under 1 MMT. The April and May shipments will mostly be counted as Chinese imports in May and June.

The chart to the right tells four stories: 1. Growing Chinese demand up to 2018, 2. Impact of tariffs in 2018, 3. The impact of ASF in China from 2018 into 2020, 4. The recovery of Chinese demand in 2020. Prior to April 2020, the largest single month export out of Brazil was just over 12 MMT. Total Brazil loadings last April were over 16 MMT with almost 12 MMT loaded for China. Preliminary data out of Brazil for May 2020 put our estimates for total loadings at 15 MMT. Brazil shipments to China in May are likely near 10 MMT. US shipments to China in each April and May are under 1 MMT. The April and May shipments will mostly be counted as Chinese imports in May and June.

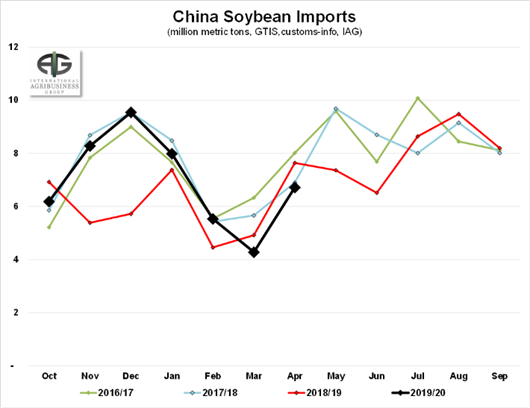

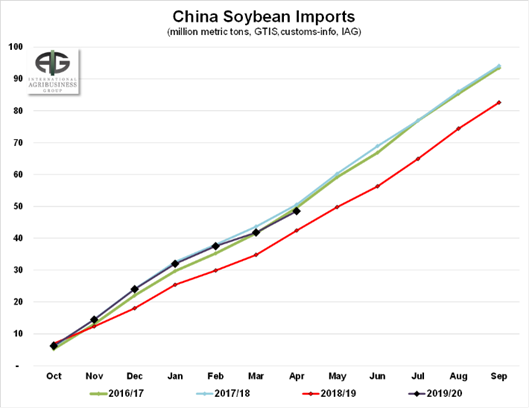

Is China stockpiling for fear of Covid delays in Brazil shipping? There is likely some of that. It could be that China is buying a weak Brazil currency. Even considering currency and stockpiling, there was evidence of a recovery in Chinese demand well before Covid hit. Chinese buying has shown signs of recovery since July 2019. The charts below show current Chinese demand in the normal range of 2016 and 2017 crop years. IAG estimate of Chinese imports in May of 9 to 10 MMT would put it close to “normal”. The current seasonal buying pattern is normal. Very few things get a “normal” label today.

1 Monthly Imports

2 Cumulative Imports

Where does that leave us for future Chinese demand? China imported the most soy in 17/18 – 94 MMT. IAG is estimating record Chinese imports of 96 MMT for the 20/21 crop year – same as USDA. We handicap that to the higher side. 96 MMT could be too low. Early estimates for the 18/19 crop imports were 103 MMT before ASF took its toll. Getting back to normal, it is likely Chinese imports move over 100 MMT within two years.

Better Chinese business is supportive to soy markets and constructive to corn markets as we push US soy acreage back toward 90 million. The US planted 90 million soy and close to 90 million corn acres in 2017 and 2018 before tariffs and ASF. Crop markets must deal with the Covid impact and an enormous pile of corn. However, shrinking US corn acreage is one requirement to getting back to “normal” stocks and prices and one the most evident methods to get there is China using more soy, regardless of the origin.