Introduction

Hydrogen, both as a pure gas and feedstock for industrial processes and refineries, has existed for years. The focus on new renewable and low-carbon initiatives supercharges hydrogen’s use in renewable fuels and refining, as a green feedstock introduced into natural gas infrastructure and delivery, and as a stand-alone fuel. The Inflation Reduction Act, the One Big Beautiful Bill Act (OBBBA) of 2025 and 45V tax credits enable the build-out of essential infrastructure, creating opportunities for companies and stakeholders across the landscape.

The Inflation Reduction Act (IRA), which was passed in 2022, and the OBBBA of 2025 maintain spending and tax incentives for clean energy across a broad spectrum. Hydrogen is the focus of this discussion, with processes that enable the lowest carbon hydrogen as the winner. Technologies and infrastructure are enabled by these credits, and hydrogen production is integrated with green or low-carbon power sources to create low-carbon hydrogen for domestic and global markets.

The New Hydrogen Paradigm

Gas and fuel with a history dating back to the early airships of the 20th century move swiftly into the 21st with a focus on greener production processes, with impressive investment and cost uplifts. Traditional hydrogen is produced by taking natural gas or propane and using a steam reforming process (SMR), often at a refinery for downstream applications. The output of the SMR is hydrogen and CO2. Hydrogen is colorless, yet its process is reflected in colors. Hydrogen is grey if the CO2 produced is emitted into the atmosphere. If the CO2 can be captured and sequestered, often injected deep into reservoir structures, it is blue hydrogen.

In contrast, electrolyzers produce green hydrogen today if the power source is renewable or very low carbon. The IRA 45 Tax Credits reward the greenest, least carbon-emitting processes with the highest credits, up to 5 times the least eligible candidates.

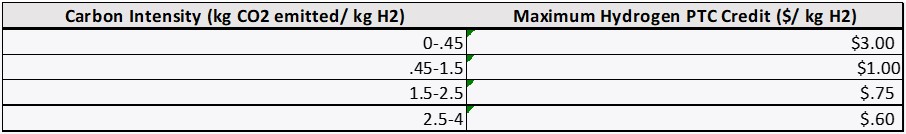

The cleanest hydrogen is measured by carbon intensity, kilograms of carbon CO2 produced per kilogram of hydrogen H2. The production tax credits or PTC are layered in four (4) tiers:

So production credits of up to $3 per kilogram are awarded for the lowest carbon-intense processes. This is the bullseye for strategies and investment.

So production credits of up to $3 per kilogram are awarded for the lowest carbon-intense processes. This is the bullseye for strategies and investment.

The Hydrogen 45V Credit

Eligibility for these credits requires a maximum of 4 kilograms CO2 per kilogram of hydrogen. Lower emitters earn higher credit returns. Key features include:

- The project must have begun construction by 2027.

- Incentive PTC credits exist for 10 years of project life.

- Greenfield (new) and retrofitting are both eligible.

- PTC credits can be sold to unaffiliated 3rd parties and transferred.

- Tax-exempt entities may receive Direct Pay or cash in lieu of credits.

- Cannot combine with 45Q Carbon Capture and Sequestration credits.

The carbon intensity is measured using an intensity model, currently the GREET model created by the US government’s Argonne National Laboratory. It is downloadable as a spreadsheet for in-depth life-cycle simulations and scenario testing, providing the backbone for the carbon intensity calculations. Only the quirkiest engineer could fall in love with this model! The mastery of this model is key to measuring the life-cycle carbon intensity, which when documented, drives the PTC credit the project qualifies for.

Waiting for the Feds…..

The investment and production community is eagerly anticipating key guidance from the US Treasury and Internal Revenue Services. Until these rules are announced, many aspects of even the most environmentally friendly processes are open to interpretation and difficult for investment decisions. For example, the manufacture of green hydrogen using renewable energy seems straightforward, but numerous unanswered questions remain:

- Must hydrogen production and renewable energy production be co-located?

- Can renewable energy from other locations meet eligibility requirements?

For instance, a hydrogen process running 24/7 using solar energy may only be eligible for solar-produced periods. Can more distant wind energy and battery resources be combined to create a 24-hour product? We are still awaiting details. A methodology that allows yearly green energy eligibility versus hourly measurement could have significant economic impacts.

The Future of Hydrogen

The use of hydrogen for earning a 45V tax credit is vast. When used as a feedstock for renewable fuels, the carbon intensity of the entire fuel calculation makes the diesel or jet fuel more valuable, making it easier to export to California and other major markets. Downstream products that use green hydrogen become more environmentally attractive for existing products. Natural gas utilities are testing the combination of traditional natural gas with green hydrogen for their Local Distribution Systems, delivering lower-carbon fuels to homes and businesses.

How Vine Can Help

At Vine, we are experts in the tax implications and impacts of complex rules, and we can help our clients navigate this complexity to deliver better results. To achieve success, it is vital that both you and Vine have a strong relationship. Our approach to helping companies work through potential investments, retrofitting, and incentive streams is thorough, as we dive deep into understanding what makes your business tick.

If you or any other organizational stakeholders are interested in hearing more about what Vine can do for you, please contact one of our advisors today.