Kenneth Gustafson, CFA

Strategy, Risk Management, Valuation and Portfolio Management

The swift downturn in financial markets from peak levels seen in early 2020 was breathtaking, and this trough has continued into 2021. The US economy has pivoted from a running on-all-cylinders, low-inflation, low unemployment strong GDP path to a grinding halt driven by COVID-19 action steps. Initial designs to reduce virus spread, infections, and mortality, and protect our healthcare capabilities have morphed into differing policy choices both at a federal, state and local level, let alone the federal changes in the executive branch. Global economies are hard hit, as the early eruption in China has spread sequentially across regions and continent, and rolling lock-downs persist. US business, both public and private entities have acted swiftly to protect and defend their enterprises against this uncertainty, at significant costs while looking for brighter signals.

Overview

Working capital focus: Revenue preservation, expense control. Businesses with positive cash flow in COVID environment focus on maximization with the knowledge that revenue opportunity is not secular, but opportunistic. Expenses need to be aligned with the opportunity. Challenged businesses must reduce costs now to survive, with the aim to profit and thrive when the economic stop-gaps are reduced. The need to retain capital and maintain linkages to your highly-trained workforce is a massive challenge. Many businesses are striving to determine what process changes are temporary, hybrid, or secular accelerations. Commercial office markets are an example of tremendous change with wide differentiation based on quality.

Capital access: Drawdown existing credit lines with eye to covenants. Access US government COVID capital programs including CARE Act. Affiliation rules limit companies to 500 or fewer employees, with total fund roll-up counts making private equity portfolio companies currently ineligible for such programs. Factor receivables if rates are attractive. The bifurcation in access to capital has benefited publics and large privates with access to more robust capital market toot kits. Roll-downs to regional financial institutions have stayed tight on financial metrics, squeezing many small and medium businesses.

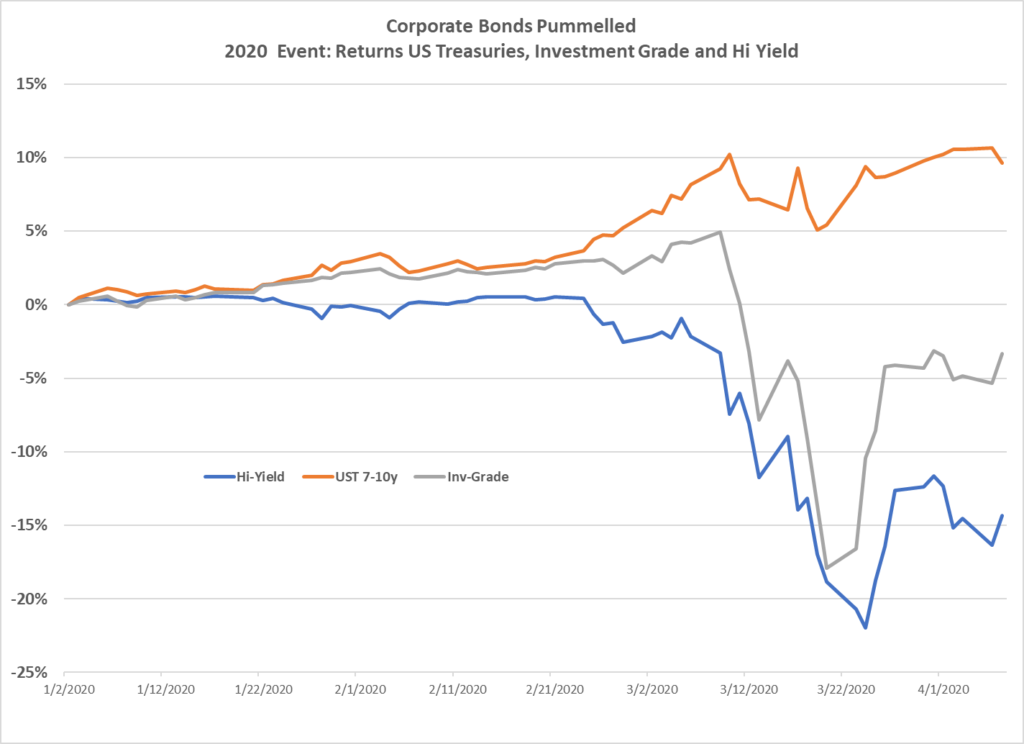

The great repricing: Equity and debt markets massively reduced pricing, with lower public and private equity valuations in the March-April 2020 sell down. Record low US Treasury yields combined with the significant widening of credit spreads for investment-grade issues, and massive widening for non-investment grade names.

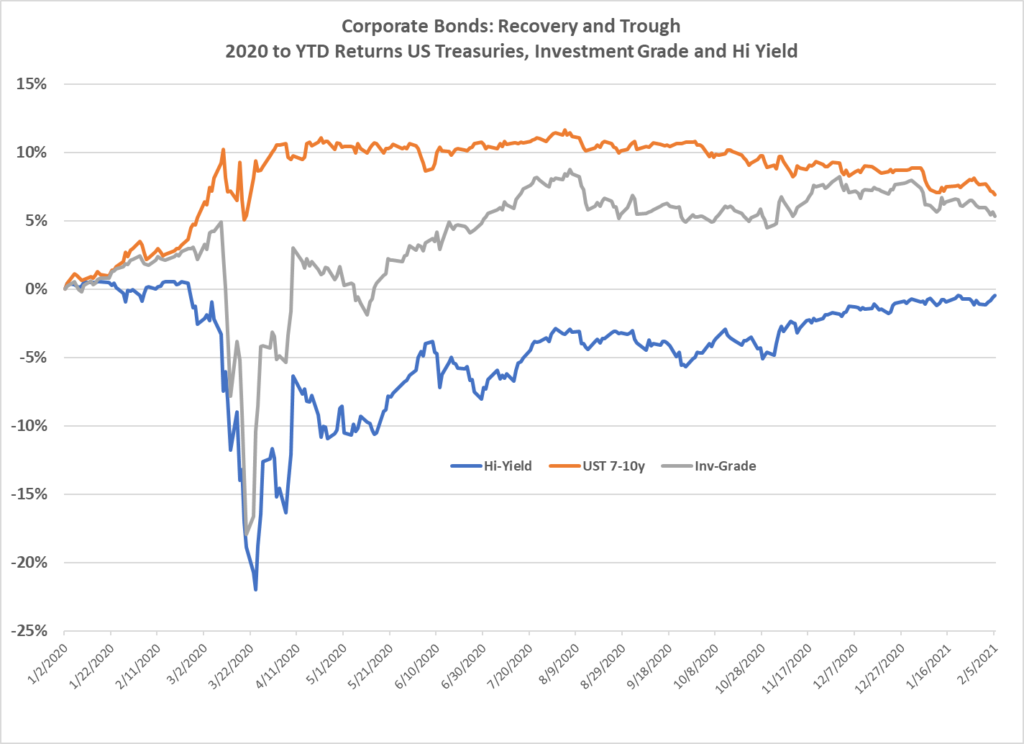

The ballistic recovery then flat: The velocity of the financial market recovery from a bleak market price abyss was breathtaking. Yet, the rally is narrow to financial markets and larger capitalizations even as debt spread have flattened as COVID surges bring policy responses. Valuation of private entities are even more challenged, requiring expertise and focus.

Private equity: Two sides of the coin. Existing funds and portfolio companies built on economic assumptions that are now changed or challenged, with leverage ratios now geared to low or little revenue. New funds find lower entry costs and a focus on cash-flow generating companies in a wide opportunity set. In many sectors, LPs are being asked to extend investment maturity windows to give funds more time to rationalize investments or capture a future economic cycle.

Energy companies: Double hit of COVID-19 erasing energy demand with OPEC+ supply threat has driven global oil and LNG prices to fantastic lows. Spreads to WTI and Brent for specific grades trade near zero, and refined product pricing collapses on surpluses. Massive contango/carry in forward price spreads brought negative prices to crude markets in April 2020. The energy recovery in prices has lagged financial recovery, with crude pricing trading to above $50/bbl, yet natural gas markets stubbornly stuck in its box of weather, production and LNG demand for global markets.

Upstream (rig counts and completions collapse, production drops, signs of recovery)

Midstream (fewer BBLs transported and processed, planned projects now online)

Downstream (demand destruction/paralysis, refining reductions and slow recovery).

How can Vine Advisors help:

Access to capital: New and existing US COVID programs, lien-based lending

Valuation: Combinations, collateral valuation

Risk management: Opportunistic exploitation and positioning, defensive revenue hedging

For more information on this article on capital raising and strategies contact Ken Gustafson at kgustafson@thevineadvisors.com